India’s digital payment market is expected to more than triple to $10 trillion by 2026, according to the latest study by digital payments firm PhonePe and Boston Consulting Group (BCG).

At present, the study said, 40% of all transactions in India are digital, and payments worth $3 trillion were processed by digital instruments in 2021.

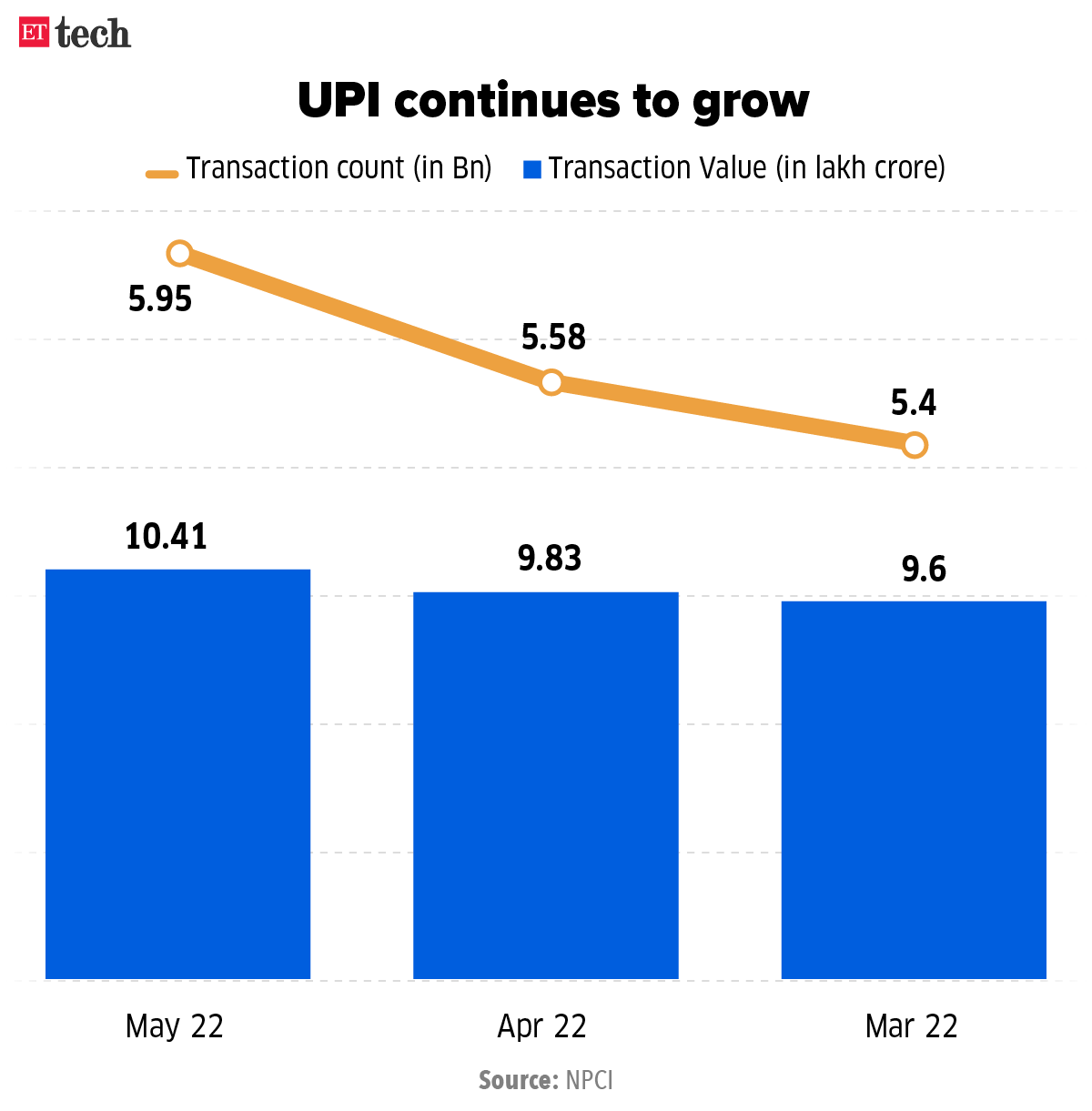

India’s Unified Payments Interface (UPI) continues to grow, clocking 5.95 billion transactions worth Rs 10.41 lakh crore last month.

According to the PhonePe-BCG study, UPI has supercharged India’s transition to non-cash payments, especially in person-to-person (P2P) fund transfers and low-value merchant (P2M) payments.

The study said UPI still has headroom to grow and will account for 73% of all digital payment volumes by FY26.

In terms of acceptance, quick response (QR) codes have played a big part in expaning digital payment services in India, the report said. At present, QR-code payments are accepted by more than 30 million merchants in the country, a substantial increase from 2.5 million merchants five years ago.

As QR-code adoption grows, total P2M transaction volumes on UPI have grown from 12% in 2018 to 45% in 2021, with further growth expected.

Offline payments are expected to account for 75% of all digital payment transactions in the coming years, as more stores adopt QR codes.