The Reserve Bank of India (RBI) recently released its report on bank notes. The survey was carried out in rural, semi-urban, urban and metropolitan areas across 28 states and 3 union territories. Let’s have a look at the important points mentioned in the report.

RBI Report on Bank Notes

- According to RBI, the total number of notes in circulation increased from 12,437 crores in 2020-21 to 13,053 crores in 2021-22.

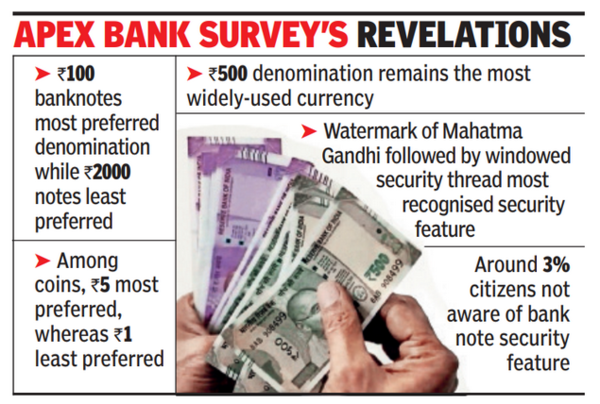

- Despite a surge in cashless payments, the Rs.100 note remains the most preferred denomination for cash transactions.

- The high value Rs.2000 note is least preferred by citizens.

- Rs.500 rupee denomination remains the most widely-used currency.

- The survey found only 3% citizens do not recognize security features on bank notes, including the Mahatma Gandhi image watermark or the windowed security thread.

- Among coins, the denomination of Rs.5 was the most preferred, whereas Re.1 was least preferred.

- The indent (bank demand) for bank notes for 2021-2022 was 1.8% lower than a year ago. Due to accumulated stock and lower demand in recent years, the coin indent was reduced by approximately 73.3% during 2021-22 compared to the previous year.

- The volume of bank notes in circulation increased by 5% during 2021-2 and Rs.500 denomination had the highest share.

- Counterfeit notes of all denominations have increased in the financial year 2021-22 (FY22). Rs.500 fake notes increased the maximum.

- As compared to last year, RBI detected 101.9% more fake notes of Rs.500 denomination and a 54.16% increase in fake notes of Rs.2,000.

Rs.2000 currency notes

The number of bank notes of Rs.2000 denomination has steadily declined over the years to 214 crore or 1.6 per cent of the total currency notes in circulation at the end of March 2022.

At the end of March 2020, the number of Rs.2000 denomination notes in circulation stood at 274 crore, accounting for 2.4 per cent of the total number of currency notes in circulation. The count declined to 245 crore or 2 per cent of the total bank notes in circulation as of March 2021 and further fell to 214 crore or 1.6 per cent at the end of last fiscal year.

Rs.500 currency notes

According to the report, the number of Rs.500 denomination notes in circulation increased to 4,554.68 crore at the end of March this year as against 3,867.90 crore in the year-ago period.

“In volume terms, Rs.500 denomination constituted the highest share at 34.9 per cent, followed by Rs.10 denomination bank notes, which constituted 21.3 per cent of the total bank notes in circulation as on March 31, 2022,” the annual report for 2021-22 said.

The Rs.500 denomination notes accounted for 31.1 per cent share at the end of March 2021 and 25.4 per cent as of March 2020. In value terms, these notes rose from 60.8 per cent to 73.3 per cent from March 2020 to March 2022.

How to identify Fake Notes?

- If the light is shed on the currency note, you will be able to see 500 written in special places.

- 500 will also be written in Devanagari on the currency note.

- Orientation and relative position of Mahatma Gandhi’s photo shifts to the right.

- India will be written on the Rs.500 currency note.

- When the currency note is bent, the security head colour will change from green to indigo.

- Governor’s signature, guarantee clause, promise clause, and RBI emblem have moved to the right of the currency note.

- Mahatma Gandhi’s photo and electrotype watermark are there on the currency note.

- Colour of the Rs.500 written on the note changes from green to blue.

- Ashoka Pillar on the right side of the currency note.

- Printed Swachh Bharat logo and slogan.