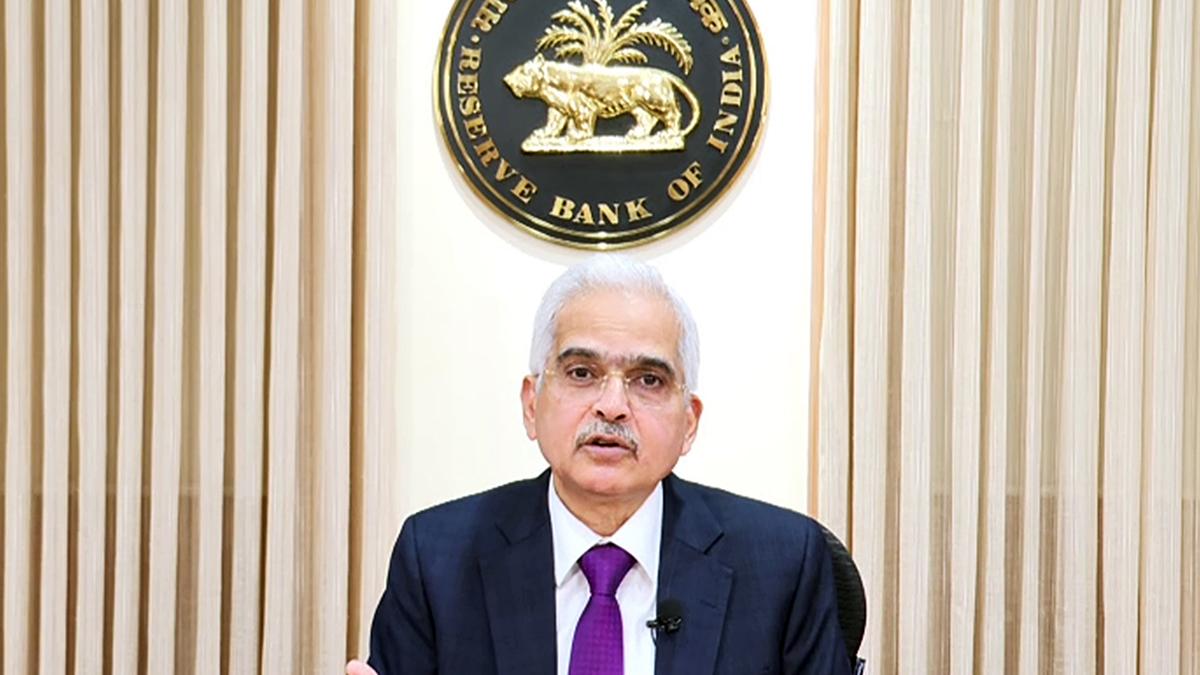

The Reserve Bank of India (RBI) recently announced its latest monetary policy decision, opting to maintain the status quo on key interest rates. This decision marks the eighth consecutive time the RBI has refrained from altering the repo rate, keeping it unchanged at 6.5%.

Reasons for Maintaining the Repo Rate

The decision to hold the repo rate steady was widely expected and is driven by the need for continuity and stability in the current economic environment. Despite concerns about inflationary pressures arising from factors like rising commodity prices and supply chain disruptions, the RBI remains committed to balancing growth objectives with price stability.

Role of Repo Rate

The repo rate, which represents the rate at which the RBI lends money to commercial banks, is a crucial tool for influencing borrowing costs and overall economic activity. By maintaining the status quo, the RBI aims to provide a supportive environment for businesses and consumers while ensuring inflation remains within its target range.

RBI’s Stance on Growth and Inflation

In its accompanying statement, the RBI reiterated its commitment to supporting growth and employment while remaining vigilant against inflationary risks. The central bank emphasizes the need for continued policy accommodation to nurture economic recovery amid challenges posed by the COVID-19 pandemic and global economic uncertainties.

Market Reaction and Future Outlook

Market reaction to the decision was relatively muted, with investors focusing on the central bank’s forward guidance and future policy actions. Attention is now likely to shift towards the RBI’s future policy trajectory, particularly amid evolving economic conditions and global developments.

Multiple-Choice Questions (MCQs):

- What is the current repo rate maintained by the Reserve Bank of India?

- A) 6.0%

- B) 6.5%

- C) 7.0%

- D) 5.5%

- Answer: B) 6.5%

- What is the primary reason cited for the RBI’s decision to maintain the repo rate?

- A) Inflationary concerns

- B) Economic instability

- C) Need for continuity and stability

- D) Pressure from commercial banks

- Answer: C) Need for continuity and stability

- What tool does the RBI utilize to influence borrowing costs and overall economic activity?

- A) Inflation rate

- B) GDP growth rate

- C) Repo rate

- D) Exchange rate

- Answer: C) Repo rate

- What does the RBI emphasize in its accompanying statement regarding economic recovery?

- A) Tightening monetary policy

- B) Reducing government spending

- C) Supporting growth and employment

- D) Increasing interest rates

- Answer: C) Supporting growth and employment

- How did the market generally react to the RBI’s decision on the repo rate?

- A) Significant increase in stock prices

- B) Strong opposition from investors

- C) Muted response

- D) Panic selling of government bonds

- Answer: C) Muted response